This post contains affiliate links, and we will be compensated if you buy after clicking on our links.

Read our review guidelines.

Filing business taxes for an LLC can be an extremely daunting task, especially if it’s your first time or have no income.

Not to worry! This helpful guide will give you every piece of information you need to make this a smooth and stress-free process.

Specifically, this guide will cover:

- How to file business taxes for the 4 main types of LLCs

- The documents you need to file your LLC taxes

- Other taxes LLCs must pay

- When the LLC tax deadline is for 2023.

Whether you’ve done it before and just need to brush up your knowledge or it’s your very first time, this is a must-read guide.

I have the one-stop LLC shop for any budding entrepreneur, business owner, start-up founder, or professional.

So what are we waiting for? Depending on the type of LLC, it only takes a couple of simple steps to get those pesky taxes done.

Helping taxpayers keep more of their hard-earned money with the biggest refund possible.

LLC Tax Filing by LLC Type

There are many different types of LLCs, each with its own unique steps for filing taxes.

If you already know your LLC’s classification, great. If you don’t, that’s okay too.

Below is an overview of the tax filing process with regard to the four key LLC types.

Single-member LLCs

A single-member LLC is when a limited liability company only has one owner.

To report the taxes of a single-member LLC, all you need to do is fill out your income and expenses on Schedule C of your personal tax return 1040 Form.

Download the form here.

Multiple-member LLCs

As the name suggests, a multiple-member LLC is owned by two or more people.

Filing taxes for a multiple-member LLC is super simple; just submit Form 1065, the partnership tax return.

Next, all you need to do is provide each member of the LLC with a Schedule K-1 tax document to denote their share of income, deductions, and credits.

Download the form here.

LLC taxed as C Corporations

An LLC is taxed as a C Corporation when it’s the LLC itself (not the owners) that pays corporate income tax on its profits.

To do so, Form 1120 or the corporate tax return needs to be filed. Income and expenses must then be reported at the corporate level.

Download the form here.

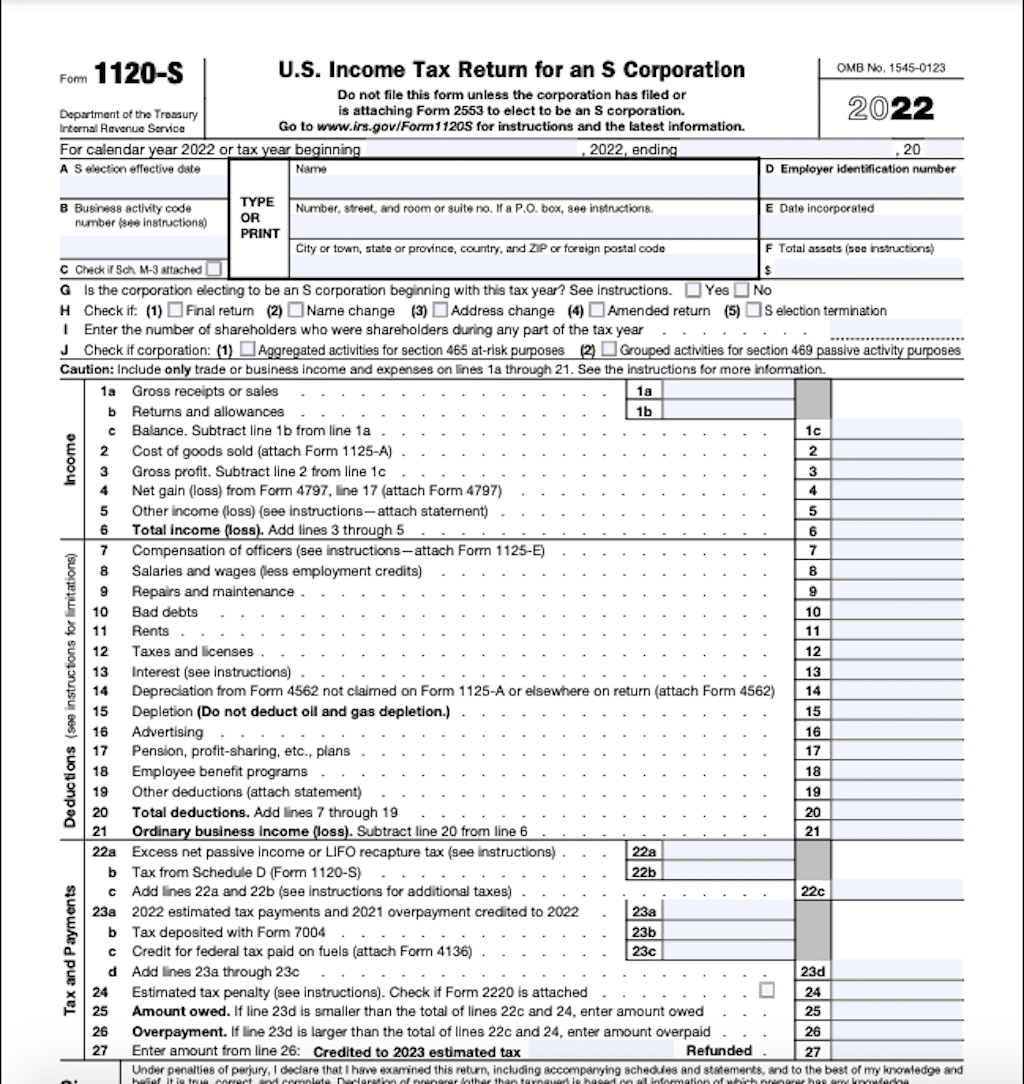

LLC taxed as S Corporations

Choosing to be taxed as an S Corporation, this type of LLC has its income and losses pass through to the shareholders.

The business must file Form 1120-S, the S corporation tax return, and also issue a Schedule K-1 to each of the shareholders.

Download the form here.

What documents do I need to file my LLC taxes?

If you’re anything like me, keeping your documents in order can be stressful and difficult.

Luckily, I’ve listed below every type of document you will ever need to file your LLC taxes:

- The financial records of your LLC; primarily, your income and expenses.

- Either your social security number or your employment identification number (EIN)

- The relevant tax forms as outlined in the section above (1065, 1120, Schedule C, etc.)

- Bank statements, financial statements, receipts, and invoices.

What other taxes LLCs must pay?

Doesn’t it feel great to pay your taxes efficiently and effectively?

Well, hold on! You’re not done yet. There might be a few more taxes that your LLC must pay before being in the clear.

- Self-employment Tax: This only applies to the aforementioned single-member LLC. This must be paid on your share of the income generated by the LLC.

- State and local taxes: This tax will vary from state to state as they each have their own obligations. Call your local taxation office for more information.

- Sales tax: Does your LLC sell goods or services? You should definitely check if you need to collect and remit sales tax to your respective state.

What is the LLC tax filing deadline for 2023?

Perhaps the most important part of this guide is the deadline for when you have to file your business taxes as an LLC.

For 2023, this date was April 17th. However, it is important to double-check this with the IRS or your respective state’s tax agency as this could change – and you certainly do not want to miss out.

Next Steps

Congratulations! You’ve made it to the end of this wonderful guide and you now know how to file taxes for your LLC.

However, you may be asking yourself: what’s next? Well, there’s always more to learn in the world of LLCs and business.

Taking the leap to read an article like this was a fantastic first step, but you should continue your search for information and endeavor to satiate that hunger for knowledge.

Only this will guarantee success. So, get out there. Ask more questions, read more guides, and be ready to learn new things.

Good luck and all the best!

FAQs

Do I file my personal and LLC taxes together?

No. File personal and LLC taxes separately. Even though single-member LLCs report business income on their personal tax returns, the filings should always remain separate.

How do I change my tax filing classification?

To change your tax filing classification, all you need to do is file the correct forms with the IRS.

For advice, contact a tax expert or the IRS itself.

What types of tax deductions are available for LLCs when filing taxes?

There are a few types of tax deductions available to an LLC when filing taxes.

They all have to relate to the business and could include business expenses, home office deductions, and travel expenses.

Can I file taxes myself or do I have to hire a tax professional?

Either, or – it depends on how much time and resources you have available.

However, most business owners tend to hire a tax professional to make sure it is done correctly and to minimize potential losses.

Helping taxpayers keep more of their hard-earned money with the biggest refund possible.